Rent-to-own agreements have become a popular option for families and individuals who want to move toward homeownership but are not yet ready to qualify for a traditional mortgage. These contracts combine renting with the option to buy, offering flexibility and opportunity. Yet not every listing is created equal. Some deals are fair and transparent, while others hide risks that can cost buyers money and peace of mind. Evaluating a rent-to-own listing carefully is the key to protecting your investment and ensuring the path to ownership is secure.

Here are five steps to guide you through the evaluation process.

Step 1: Verify Seller Legitimacy

The first step is to confirm that the seller has legal authority to offer the property. Fraudulent listings are more common than many realize. Some individuals advertise homes they do not own, collect option fees, and disappear. Others may have unresolved liens or unpaid taxes that complicate ownership.

Check public records to confirm ownership. County or city offices maintain property records that list the legal owner. Compare the seller’s name with these records. If they do not match, that is a red flag.

It is also wise to ask for documentation of ownership and disclosure of any debts tied to the property. Sellers who resist providing proof should be avoided.

Step 2: Review the Contract in Detail

A rent-to-own agreement must be in writing to be enforceable. Verbal promises are unreliable and cannot protect you in court. The contract should clearly outline:

- Monthly rent and how credits are applied.

- Option fee amount and whether it is refundable.

- Maintenance and repair responsibilities.

- Purchase price or method of determining it.

- Timeline for exercising the purchase option.

Ambiguity in contract terms often leads to disputes. If the agreement is vague, ask for revisions. Having an attorney review the contract before signing is one of the best ways to avoid hidden risks.

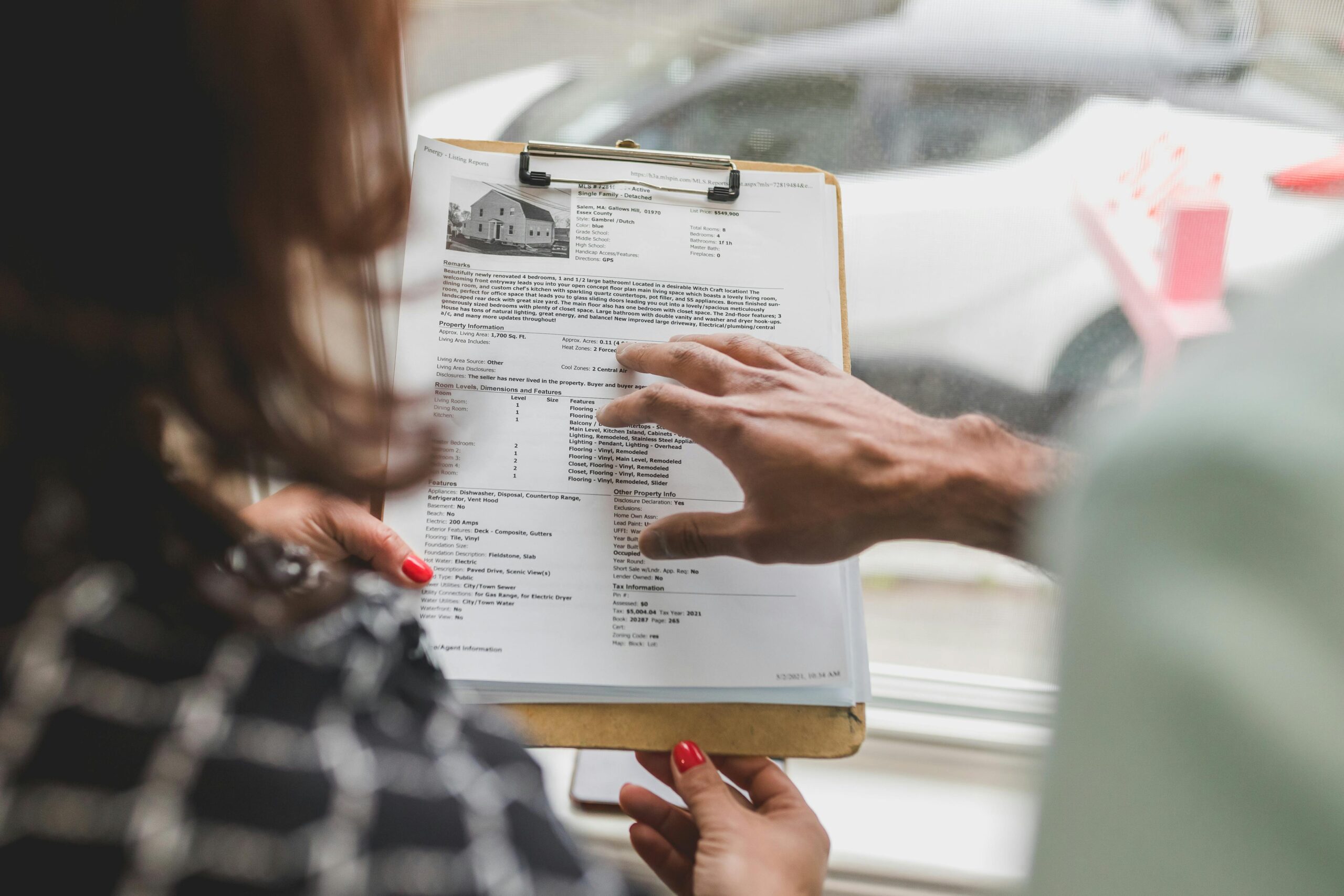

Step 3: Inspect the Property Thoroughly

Property condition is a critical factor in rent-to-own deals. Tenants often take on repair responsibilities during the lease period. Without a clear understanding of the property’s condition, you may face unexpected costs.

Request a professional inspection before signing. Inspectors can identify structural issues, safety hazards, and repair needs. Take photos of the property’s condition at move-in and keep the inspection report for your records.

This step is especially important when contracts assign rent-to-own property repairs to the tenant. Knowing what you are responsible for helps you budget and prevents disputes later.

Step 4: Evaluate Financial Readiness

Rent-to-own agreements are designed to give tenants time to prepare for financing. Yet not all tenants use this period wisely. Improving credit scores, reducing debt, and saving for closing costs are essential steps.

Before committing, evaluate your financial readiness. Ask yourself:

- Can I afford the monthly payments comfortably?

- Do I have savings for emergencies and closing costs?

- Is my credit improving, or do I need more time?

Lenders will review your financial profile when the purchase option becomes available. Strong credit, stable income, and manageable debt increase the likelihood of mortgage approval.

Step 5: Research Local Laws and Market Conditions

Housing laws vary by state and city. Some regions require specific disclosures, while others limit how option fees are handled. Contracts that fail to comply with local laws may be unenforceable.

Research local regulations before signing. Consult with a local attorney to confirm compliance. This step protects you from future disputes and ensures the agreement is valid.

Market conditions also matter. If property values are rising, locking in a purchase price early may be beneficial. If values are declining, tying the price to market value at the time of sale may be safer. Understanding the local market helps you negotiate fair terms.

Putting It All Together

Evaluating a rent-to-own listing requires more than a quick glance at the property. It involves verifying seller legitimacy, reviewing the contract, inspecting the property, assessing financial readiness, and researching local laws and market conditions. Each step builds protection and confidence.

Rent-to-own agreements can provide a path to ownership, but only when they are fair, transparent, and legally binding. Buyers who take time to evaluate listings carefully reduce risks and strengthen their path to homeownership.

Leave a Reply