-

Rent-to-Own vs Owner Financing: Which One Fits Your Situation

Rent-to-own and owner financing both offer alternative paths to homeownership. They appeal to buyers who may not qualify for traditional mortgages or who want more flexibility. But these two options work in very different ways. Choosing the right one depends on your financial situation, long-term goals, and how ready you are to take on ownership

-

How Rent-to-Own Impacts Your Credit Over Time

Rent-to-own agreements offer a flexible path to homeownership, especially for buyers who need time to improve their credit. While these deals do not always show up on your credit report, they can still affect your credit in indirect ways. Understanding how rent-to-own impacts your credit over time helps you avoid setbacks and prepare for loan

-

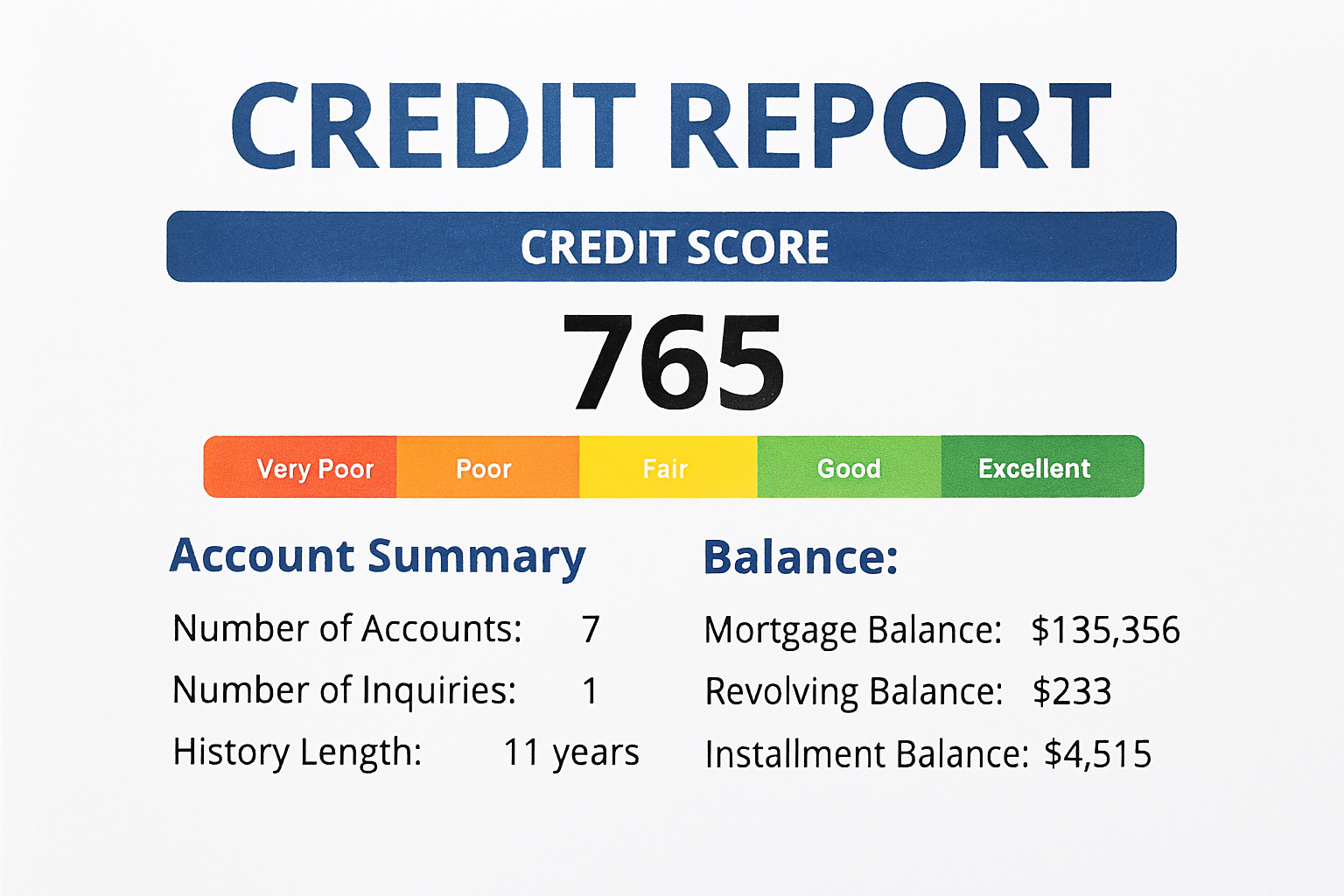

Credit Score Requirements for Rent-to-Own Buyers

Rent-to-own agreements offer a flexible path to homeownership, especially for buyers who need time to improve their credit. These deals let you rent a home now and buy it later, often with a portion of your rent going toward the purchase. But while credit checks may be relaxed at the start, your credit score still

-

Rent-to-Own and Debt: What You Need to Know

Rent-to-own housing may look like a shortcut to homeownership. You move in, pay monthly rent, and eventually buy the place. But behind the promise of ownership lies a web of financial risks that many buyers overlook. These deals often blur the line between renting and buying, and that confusion can lead to debt traps. Here

-

How to Use Rent Credits Toward Your Purchase Price

Rent-to-own agreements offer a flexible path to homeownership, especially for buyers who need time to build credit, save for a down payment, or stabilize their income. One of the most valuable features in these agreements is the rent credit. This is a portion of your monthly rent that can be applied toward the future purchase

-

How to Budget for Rent-to-Own Monthly Payments

Rent-to-own agreements offer a flexible way to move toward homeownership, especially for buyers who need time to build credit or save for a mortgage. But flexibility does not mean low cost. These deals come with unique financial responsibilities that require careful planning. Budgeting for monthly payments is one of the most important steps in making

-

Rent-to-Own Homes or Traditional Mortgages -Which is Right for You?

Choosing the best path to homeownership can be a daunting task, especially when faced with different financing options. Two popular routes are rent-to-own agreements and traditional mortgages. This blog post will compare these options, examining the pros and cons of each to help you determine which one might be right for you. Understanding Rent-to-Own Agreements